Originally posted to Data Center POST

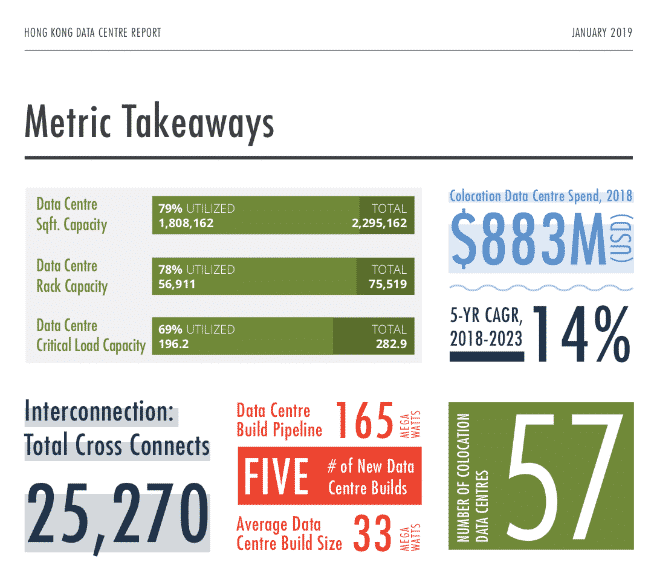

Across the world, Hong Kong is known for its vibrant culture, fast-paced urban feel and towering skyline. As part of the second largest economy in the world, this metropolitan mecca in China is no stranger to being at the forefront of the global stage, especially when it comes to the data centre industry. In 2018, the Hong Kong data centre colocation market was worth $883m and is projected to continue on its steady upward trajectory to reach $1.7b by 2023. Serving as both a critical network hub for mainland Chinese businesses to expand internationally and a gateway to mainland China for international players, Hong Kong’s market is a crucial piece of the larger market fabric and a magnet for hyperscale cloud platforms. To catalogue the state of the data centre colocation, hyperscale cloud and interconnection market in Hong Kong, Structure Research produced a thorough report synthesizing the industry conditions from the perspective of revenue generation, space and power.

Across the world, Hong Kong is known for its vibrant culture, fast-paced urban feel and towering skyline. As part of the second largest economy in the world, this metropolitan mecca in China is no stranger to being at the forefront of the global stage, especially when it comes to the data centre industry. In 2018, the Hong Kong data centre colocation market was worth $883m and is projected to continue on its steady upward trajectory to reach $1.7b by 2023. Serving as both a critical network hub for mainland Chinese businesses to expand internationally and a gateway to mainland China for international players, Hong Kong’s market is a crucial piece of the larger market fabric and a magnet for hyperscale cloud platforms. To catalogue the state of the data centre colocation, hyperscale cloud and interconnection market in Hong Kong, Structure Research produced a thorough report synthesizing the industry conditions from the perspective of revenue generation, space and power.

According to Structure Research’s report, Hong Kong’s data centre sphere has two main drivers: hyperscaling and space.

Hyperscale refers to data centres with at least 5,000 servers that span more than 10,000 square feet in size. On a global scale, China is currently second to only the U.S. in terms of hyperscale data center operations. Hong Kong’s hyperscale market also has the unique advantage of being the only market in Asia Pacific where hyperscale cloud providers such as AWS, Microsoft, Google and Alibaba are fully leasing their capacity requirements from colocation providers instead of building their own. This particular subset of hyperscalers is a key driver of absorption of new data centre supply. Due to its growing demand for wholesale colocation, the Hong Kong market will likely split between retail, mainly utilized by smaller businesses, and wholesale earlier than previously expected. As it stands, Structure Research notes that the hyperscale cloud providers account for over 30 percent of sold data centre capacity in the Hong Kong market, a figure that is expected to rise as the market moves forward and cloud adoption accelerates in the region.

To read the full article please click here.