According to Synergy Research Group, the total volume of data center mergers and acquisitions that closed last year was approximately $20 billion. Those 48 transactions surpassed a total of 45 deals that transpired during the previous two years combined.

While it’s too early to predict if this upward trend in data center M&As will continue — driven in part by enterprise data center outsourcing, and the dramatic growth of cloud providers as data center operators strive to help them rapidly increase scale and global footprint — a major sale of data center assets has just completed.

Infomart Data Centers, an award-winning industry leader in building, owning and operating highly efficient, cost-effective wholesale data centers, recently announced that IPI Data Center Partners Management, LLC has purchased three Infomart facilities as well as its management company. IPI Partners is an investor in data centers and other technology and connectivity-related real assets. The financial terms of the purchase agreement were not disclosed.

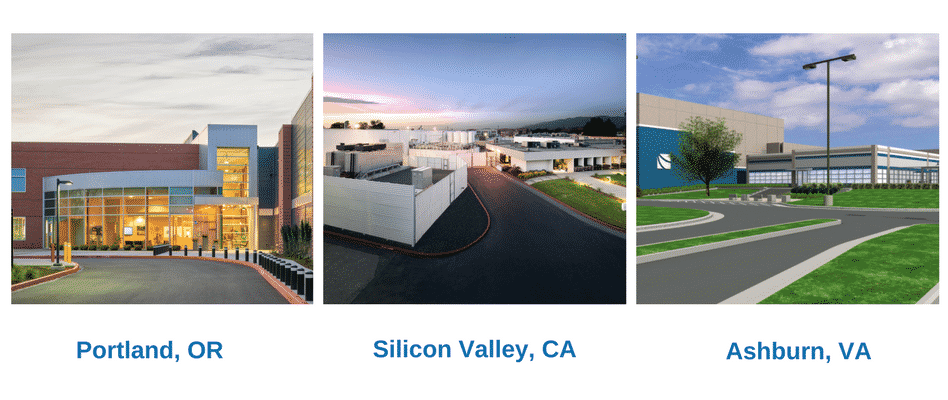

An affiliate of IPI Partners will acquire Infomart’s data centers in Ashburn, Virginia; Hillsboro, Oregon; and San Jose, California. Infomart has a history of attracting top-tier global technology and enterprise customers. The three data centers total 665,000 square-feet with 27.2 megawatts of total in-place capacity along with an additional 29.7 megawatts of potential expansion. Both in-place capacity and expansion opportunities will assist the affiliate of IPI Partners to continue to grow with existing and new tenants.

IPI Partners Management, which also invests in connectivity-related real assets, is sponsored by ICONIQ Capital, LLC and is an affiliate of Iron Point Partners, LLC.